Bank reconciliation

Automatic Bank Reconciliation in Oracle JD Edwards

can celebrate! The solution has arrived with great cost x benefit

Now, using mostly standard JD Edwards programs, Brazilian customers have the Automatic Bank Reconciliation feature in their hands.

Now, using mostly standard JD Edwards programs, Brazilian customers have the Automatic Bank Reconciliation feature in their hands.

The Automatic Bank Reconciliation process, developed by MPL, was created to meet the requirements of many of our customers and to fill a JD Edwards functionality gap. The final result is presented as an additional functionality of the system, since it was developed using JD Edwards' own tools, with the same standards of online and batch applications.

1. Benefits

- Allows automatic bank reconciliation.

- From the bank statement records and their transaction type, it is possible to automatically generate accounting entries for interest, fees, bank fees and others.

2. Key Features

- Import of Bank Statement;

- Consultation of Imported Bank Statement Records;

- Automatic Bank Reconciliation between the Bank Statement and the Accounting Entries in the General Accounting Module;

- Consultation of Accounting Entries for manual reconciliation of pending items;

3. How It Works

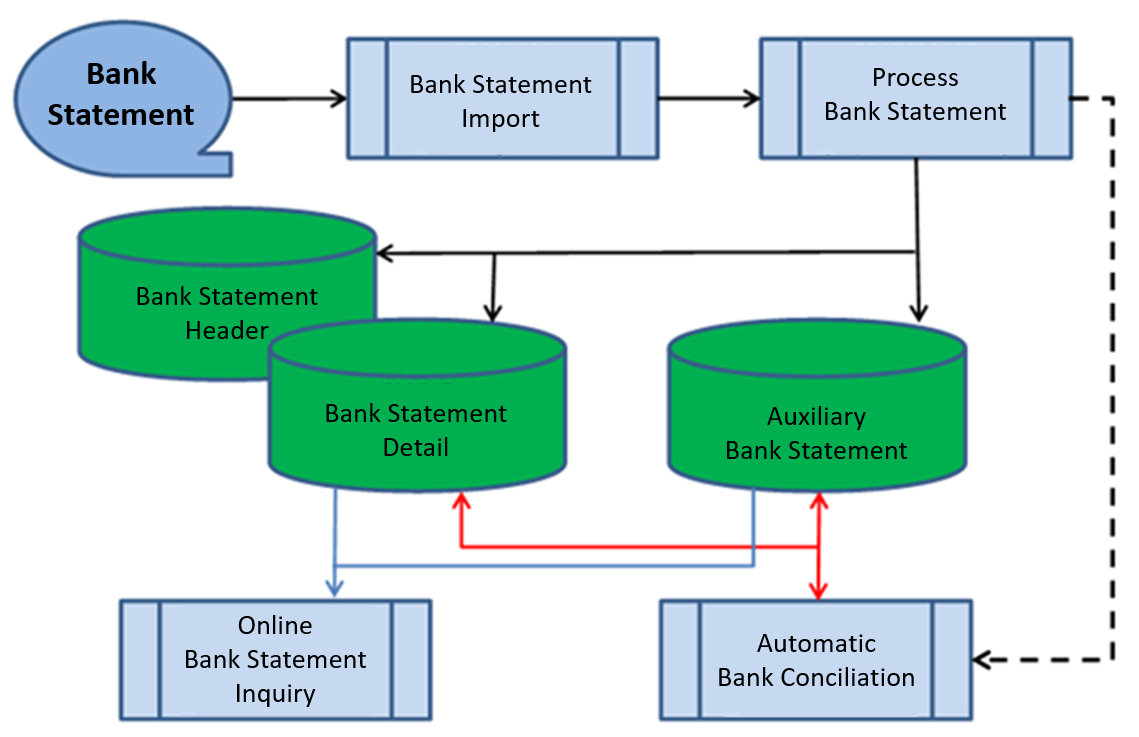

The Automatic Reconciliation process starts with the JD Edwards standard program for updating the G/L Entries Reconciliation table (GL Reconciliation File – F0911R) and continues with the bank statement import.

After importing the bank statement, a new batch program is run to match the journal entries, marking them as matched in table F0911R.

Automatic reconciliation is performed using the accounting date and value as parameters. If there is more than one entry on the bank statement or account ledger with the same information, the reconciliation process will match the oldest entry among those found.

The automatic reconciliation program will also generate automatic accounting entries according to bank statement records identified as “independent records”, such as interest, fees or any other type of fee that may be charged by the bank and has no relationship with receipts from customers or payments to suppliers. These independent records are identified by their transaction type and the generation of the accounting entry obeys the settings made by the user.

After running the automatic matching process, users – through standard JD Edwards programs – can query the matched records, undo the matching, and mark any pending records as matched.

4. Assumptions

- The Automatic Bank Reconciliation product is supported from version 9.0 of JD Edwards;

- Due to the different levels of ESUs installed in each client, some type of adjustment to the Automatic Banking Conciliation programs may be necessary;

- Before starting the Bank Reconciliation project, we have to ensure that no objects customized by the client match the objects created by MPL;

- The Automatic Bank Reconciliation process can be executed as often as desired by the user;

- The import of the Bank Statement is now ready for Banco Itaú. Programs for importing extracts to other banks will be developed when necessary.

5. Deployment Service

Considering that there will be no coincidence of objects between those developed by MPL and those already customized by the client, the project lasts approximately 15 working days. The project duration can be revised according to the scope agreed between MPL and the client, and will be part of the first project activity.

More Security and Quality for your Business

Count on our experience in JD Edwards solutions. Enter in contact with us.